For todays episode, we discuss how we came to the conclusion of a goal of 5 million kroner in 5 years using these calculators. To be honest, it’s not our final goal. However, it is a goal we can see ourselves reaching that will still make a significant difference for our current living situation.

The first step in creating your goal is to be aware of your budget. There are many tools out there to help get an overview of your living expenses and making a budget. We personally use Spiir, but budgetting tools is a topic for another day.

Budget

We took a look at our expenses for the last 12 months and created a Sankey diagram as seen below.

The diagram depicts our average monthly expenses and savings over the past 12 months post-tax. This gives us valuable information in two areas.

- What is our expenses/savings distribution

- Which categories are good targets for lowering expenses/increasing savings

We observe that the distribution of money going to expenses/savings is roughly 50%. We actually think that is fair and doesn’t cause any red flags. However, as we delve deeper into the expenses, two categories catch our attention, “Housing” and “Food”. We want to bring these two expenses down.

For the housing expense, we moved in together during the last 12 months and are in the middle of moving again, this time to Copenhagen. Therefore, we currently have both, rent for two separate places and moving costs, factored in. Going forward, we are planning on going from living on our own, to living with roommates to help keep housing costs low when we move to Copenhagen.

For the food category, we both like to indulge ourselves from time to time. Mr. Denmark likes ordering burgers and Ms. Canada likes going out for drinks with friends often. We have already started changing some habits to decrease how much we order fast food and being more aware of what we spend at restaurants and bars, which should also help. Also those numbers are again, for two people living alone, and we aim to bring our grocery bill down with some meal planning.

That gives us two scenarios, we either stay with our current budget or make said adjustments. If we make adjustments, we think we can save 4000 kr on housing and 3000 kr on food. As we like round numbers, that would put the monthly expenses down to 25,000 kr and the savings up to 39,000 kr. Shifting the distribution to 40% expenses, 60% savings, which sounds very good to us.

We think we can make these adjustments, for a limited time, to boost savings. However, we don’t see ourselves living with roommates forever and would also like a little more wiggle room to go to nice restaurants. Therefore, long term, we will go with the 28,000 kr in expenses per month.

Calculating the goal

Going by the expenses and savings discussed above, t0 become truly financially independent, all our expenses have to be covered. 28,000 kr a month means 336,000 kr per year.

Most of our investments are in the form of stocks. Even though it is impossible to know how the stock-market is going to be in the coming years, for the sake of simplicity, we will go with a 6 % return on investments. As well, we include the Danish tax of 42% on capital gains in our calculations. With these numbers we can calculate how much money (x) we need to have invested in stocks to cover the yearly expenses.

We should note that the tax on gains in Denmark is not simply 42%. Tax laws are never so simple. In Denmark, however, we have multiple tax rates, depending on how and where your money is invested. Here are the tax considerations as of 2021 for investments in Denmark.

- Aktiesparekonto – A stock savings account where you are allowed to have up to 102.300 kr in deposit (as of 2021). The returns of investment has a 17 % tax rate. But what you can invest in is limited to the positive list provided by Skat.

- Returns under 56.500 kr per year are taxed at 27%. If you are a married couple, this means you have a cap of 113.000 kr per year for this tax rate.

- All returns over 56.600 kr are taxed at a gaping 42%!

For the sake of simplicity in this article, and since a lot of things may not go according to plan, we go with the heavy tax rate of 42%. That being said, it is always important to look for special accounts or programs in your own country to minimize taxes and fees paid on investments!

Note, that we don’t plan on withdrawing from the investment like normal retirement calculators do using the 4% rule. We don’t plan on retiring any time soon and if we were to use to interest to live on, it would be temporary (e.g. to take time to start a business or for extra time off if we were to have children), so for us this makes the most sense.

![]()

By isolating x we get:

![]()

That means we need to save up 9.7 million kr for both of us to become financially independent. That is a large number, and definitely the goal long term. For a start, we aim to cover expenses for one of us, meaning half of the 9.7 million kr. If we round that gives us 5 million kr.

For us, it is a good first goal. We aim to reach that in just five years time. Beyond that, who knows what the future holds? But 5 million kr gives us the opportunity to have one person take some time off, in order to pursue other interests or just in general, gives us a lot more financial freedom. Freedom, in case we are off work or need to work part time for some time.

Is this even possible?

So the question becomes, can we do it? Not from scratch, that would be impossible. With our jobs it would be over 100% of our pay check. We are starting in a good place as we have almost 2 million already.

We look at formulas for three scenarios

- Monthly investment with zero returns

- Monthly investment with annual returns

- Monthly investment with annual returns- tax

Before we show the formulas, let’s get some variables defined:

- t is the time in years

- b is the initial deposit

- a is the monthly investment

- r is the annual investment returns rate

- g is the tax rate of the investment returns

- s is the savings function

For the first scenario, it is a matter of holding a savings account without investing, assuming 0% interest rate. In Denmark, many places, the interest rate is actually negative if you hold over 100.000 kr!

That being said, here is the function:

(1) ![]()

No rocket science there, it is just a matter of multiplication

For the second scenario, we got a little help from The Calculator Site in order to take into account the rule of compounding in addition to monthly investments. For the sake of simplicity. We have adjusted the formulas to just be returns off investments once a year.

With adjustments, the formula then becomes:

(2) ![]()

To understand the formula, the first part deals with the returns of your initial deposit. The second part deals with the returns of your monthly investment.

For the third scenario, we have altered the previous formula a little bit, to reflect tax off of the returns of investment. The formula thus becomes:

(3) ![]()

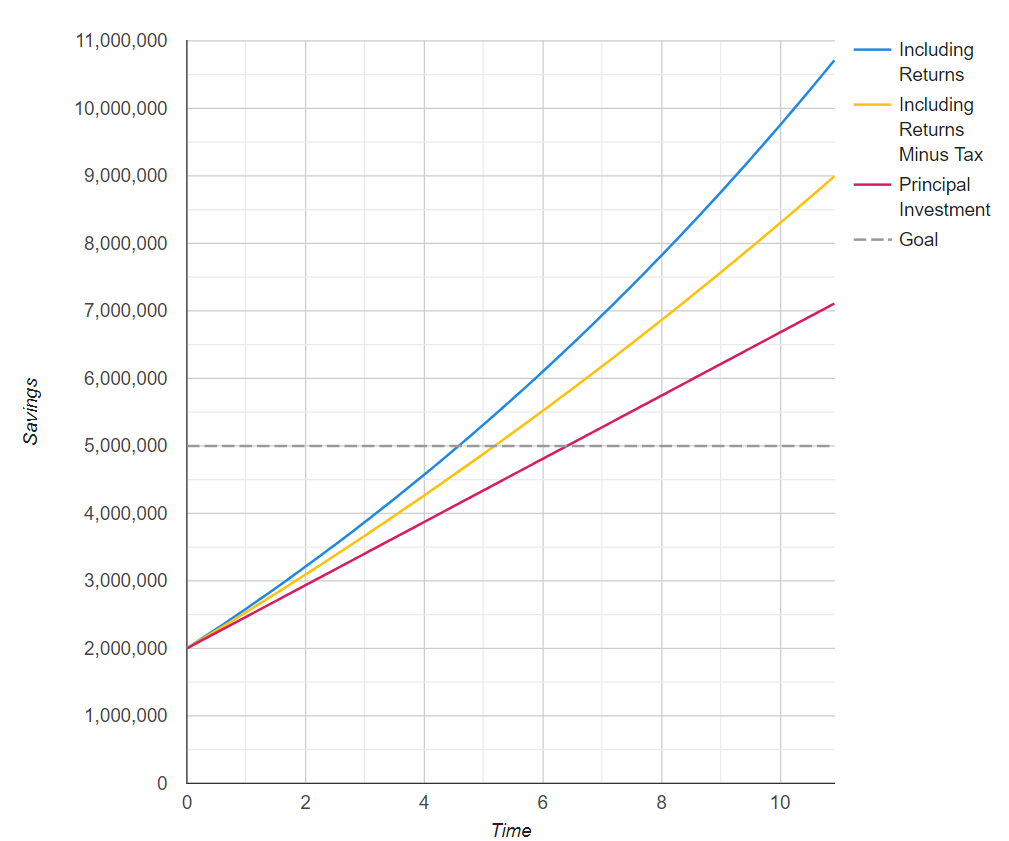

With all of this discussed, we can use the savings calculator to get an estimate of our savings amount over time.

Looking at the graph, some things become apparent.

The rule of compounding does not come into play in the short-term, but over time, with more compounding periods, it begins to matter. Admittedly, our returns rate of 6% might be a bit conservative. We are not investment experts, if that was the case, then delving into more details into shorter compounding periods would be relevant. For 5 years time, we see almost a one million kr difference between 0 % returns and 6 % return of investment, which is definitely helpful. However, in the short term, saving more is more important than investing better.

We can also observe that without considering tax, if everything goes according to plan, we should reach our goal. However, when we take the tax into account, we will be 120.000 kr short. A lot can change in 5 years time, maybe our salary increases, maybe we beat our current savings goals, maybe some of the assumptions we made in this article are completely off. Who knows. But to make our goal, we need to revisit the plan every year and reassess the feasibility.

Overall, it will be tight for us to reach our goal, but it wouldn’t be interesting if it wasn’t tough, right?

If we pull it off we will be over halfway to our final goal of 9.7 million kr. We might not get there, but we sure will try. No matter what happens, the money we save will be helpful for our future endeavours.

The passive income and money on its own is pretty nice. We could buy a house without a mortgage, we could take half a year off work to start our own business, it opens up a multitude of possibilities.